A void check has been marked unusable, either by the issuer or a bank! Void checks can be a very useful banking tool when you use them right.

What is a Void Check?

A nullified banking check is actually a traditional check, either handwritten or printed, upon which the words “NULL” or “NULLIFIED” composed in hand or by a stamp across its face.

Normally, you need to maintain your financial relevant information exclusive to defend on your own coming from scams and also identification burglary. Do not leave your chequebook, blank checks, or even duplicates of your examinations where other individuals may locate all of them.

Checking out profiles may not be everything about checks. They may additionally usually be actually made use of to get straight down payments and also help make automatic remittances. These purchases may streamline your funds as well as offer you a lot more control over your down payments and also drawbacks.

In many cases, you can easily establish automatic purchases online. In various other instances, however, you’ll must complete some documentation as well as supply a null check, which has your financial institution’s transmitting amount and also your profile variety on it.

Listed below’s what you require to understand to give that null check.

- License your company to point down payment your wage or even incomes.

- License your company to point down payment your cost repayments.

- License an authorities organization to instruct down payment your perk examinations.

- Put together automatic funding repayments (e.g., mortgage loan, trainee finance).

- Put together computerized expense repayments (e.g., electricals, bank card).

- Automated settlements are actually often described as “auto-pay,” which pertains to repayments that are actually instantly taken out coming from your profile.

When to Make Use Of a Null Check

A null check can easily certainly not be actually filled out, paid or even placed. That may make it seem to be worthless, however in reality a nullified check possesses a particular function, which is actually to make it much easier for you to discuss your financial relevant information along with another person.

When you need to have to offer your financial details to somebody else for a reputable objective, a vacated examination could be helpful. Instead of stealing your financial institution’s transmitting variety and also your profile variety coming from all-time low of your banking check onto a kind as well as probably slipping up, you may give a null check that currently has actually that info imprinted on it. The individual acquiring your vacated examination may utilize that relevant information to put together a digital deal for your profile.

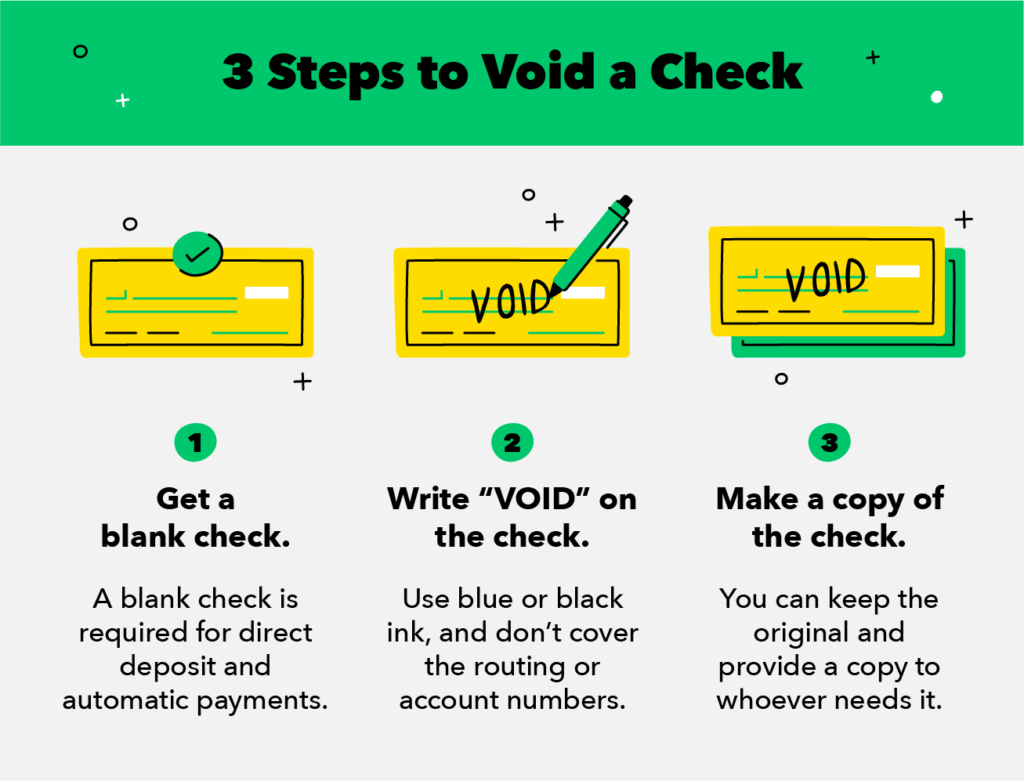

If you need to offer an invalidated examination, you do not must seek one coming from your financial institution or even lending institution. You can easily merely separate an examination coming from your source as well as compose “GAP” on it on your own. Words “SPACE” does not need to deal with the whole entire null check, yet it must allow good enough and also black good enough to ensure that the examination may certainly not be actually utilized. Do not edit the financial amount details at the end of the examination.

You could make use of a Nullified Check to:

You can easily additionally create “SPACE” on an inspection if you miscalculated loading it out however do not would like to toss it away or even snippet it. This form of removed inspection may be beneficial for record-keeping. Due to the fact that examinations are actually sequentially phoned number, if you damage a paycheck instead of smudge it “SPACE,” you eventually may certainly not bear in mind that you really did not make use of that inspection.

Null Check Example

Alternatives to a Voided Examine

Oftentimes, a nullified inspection is going to be actually the most convenient technique to accredit straight down payments or even auto-pay. If you do not possess a source of newspaper inspections or even you do not wish to lose one to be actually nullified, you’ll possess to think out a choice.

Rather than a Null Check, you may Want to Consider:

A straight down payment permission kind. When you finish this kind of application, be actually really mindful certainly not to produce any sort of errors when you complete your financial institution’s directing variety as well as your profile amount.

A removed null check. A counter top examination is actually a null check identical to the short-term or even starter inspections that you could possess obtained when you opened your profile. If your financial institution or even lending institution gives contrarily inspections, you can easily ask for one coming from a bank clerk at any one of the division sites. Counter examinations acquire their title coming from the bank employee’s home window, or even contrarily.

- A certificate of deposit along with your financial relevant information preprinted on it. Your source of inspections may feature some published certificate of deposit tied right into the pile under the examinations.

- A xerox of a check or even certificate of deposit for your banking account. Which of these choices you’ll have the capacity to utilize relies on what your banking company or even lending institution promotions, what your recipient demands and also your individual desire.